Property Mortgage Refinancing in Dubai: Save Thousands on Your Loan

Are you among the thousands of Dubai homeowners paying more than necessary on your mortgage? With interest rates showing favorable trends throughout 2025 and banks competing aggressively for refinancing business, now might be the perfect time to reassess your home loan. Mortgage refinancing has emerged as one of the smartest financial strategies for property owners in Dubai, potentially saving you tens of thousands of dirhams over your loan term.

Whether you secured your mortgage during the high-rate period of 2022-2023 or simply want to take advantage of today’s competitive market, understanding refinancing can transform your financial future. This comprehensive guide explores everything you need to know about mortgage refinancing in Dubai—from calculating potential savings to navigating the application process with confidence.

Quick Refinancing Reality Check

Current fixed-rate mortgages in Dubai start from 3.79%, down significantly from 2023 peaks. Homeowners refinancing from 4.5% to 3.5% on a AED 2 million mortgage save approximately AED 2,400 monthly—that’s AED 28,800 annually or over AED 500,000 across a 20-year term.

What is Mortgage Refinancing?

Mortgage refinancing involves replacing your existing home loan with a new mortgage, typically offering better terms, lower interest rates, or more favorable conditions. The new loan pays off your original mortgage, and you begin making payments under the revised agreement. In Dubai’s dynamic real estate market, refinancing has become increasingly popular as homeowners seek to optimize their financial positions.

Unlike simply switching payment plans or requesting rate adjustments from your current bank, refinancing means establishing an entirely new loan agreement—often with a different lender. This process involves property revaluation, credit assessment, and re-registration with the Dubai Land Department, but the potential savings make it worthwhile for many homeowners.

Why Consider Refinancing in 2025?

The mortgage landscape in Dubai has transformed dramatically since late 2024. Following three consecutive interest rate cuts by the US Federal Reserve—mirrored by the UAE Central Bank—the Emirates Interbank Offered Rate (EIBOR) has eased considerably. This creates compelling opportunities for strategic refinancing across Dubai’s property market.

Lower Interest Rates

Banks are now offering fixed-rate mortgages starting from 3.79%, significantly lower than rates available just 12-18 months ago. If your current mortgage rate sits at 4.5% or higher, refinancing could deliver substantial monthly savings. The difference between a 4.5% and 3.5% rate on a AED 2.5 million mortgage amounts to approximately AED 2,400 per month—money that could be redirected toward investments, savings, or improving your lifestyle.

Switch from Variable to Fixed Rates

Homeowners with variable-rate mortgages linked to EIBOR have experienced payment volatility over recent years. Refinancing to a fixed-rate mortgage provides payment predictability, eliminating concerns about future rate increases. This stability is particularly valuable for long-term residents planning their financial futures in Dubai.

Access Home Equity

Dubai’s property market has seen significant appreciation across prime areas like Downtown Dubai, Dubai Marina, and Business Bay. Through cash-out refinancing, you can tap into this equity for children’s education, business investments, or acquiring additional properties. This strategy is particularly powerful for investors building their Dubai real estate portfolios.

Adjust Loan Terms

Refinancing allows you to modify your loan duration. Shortening from 25 to 15 years increases monthly payments but dramatically reduces total interest paid. Conversely, extending your term lowers monthly obligations, freeing cash flow for other priorities. The flexibility refinancing provides helps align your mortgage with your current financial situation and goals.

Real Savings Examples: The Numbers That Matter

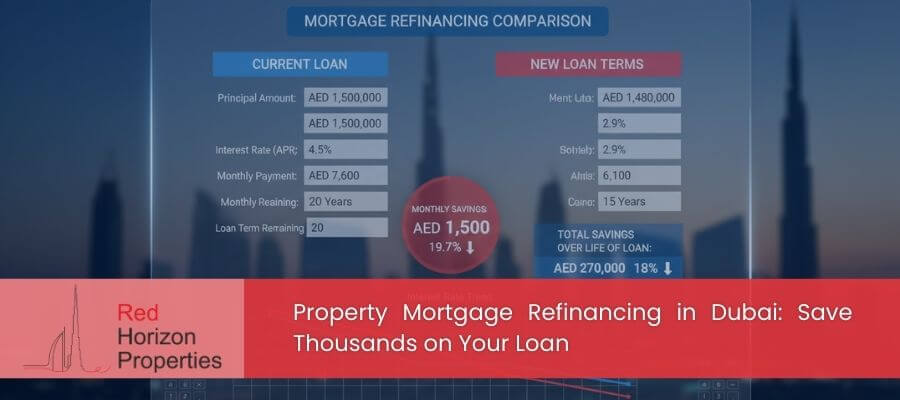

Understanding potential savings requires examining real scenarios. These calculations demonstrate how refinancing impacts different mortgage situations across Dubai properties:

| Scenario | Original Terms | Refinanced Terms | Monthly Saving | Total Interest Saved |

|---|---|---|---|---|

| Dubai Marina 2BR | AED 1.5M @ 4.8%, 20 yrs | AED 1.5M @ 3.8%, 20 yrs | AED 1,540 | AED 369,600 |

| Business Bay Studio | AED 800K @ 5.0%, 25 yrs | AED 800K @ 3.9%, 25 yrs | AED 740 | AED 222,000 |

| Downtown 3BR | AED 3M @ 4.5%, 25 yrs | AED 3M @ 3.5%, 20 yrs | AED 1,890 | AED 653,600 |

Understanding Refinancing Costs

While refinancing offers compelling benefits, understanding the associated costs is crucial for accurate break-even calculations. These expenses are typically recovered through monthly savings within 12-24 months for favorable refinancing scenarios.

Typical Refinancing Costs in Dubai:

- Early Settlement Fee: Up to 1% of outstanding balance or AED 10,000, whichever is lower (check your mortgage terms)

- New Bank Processing Fee: Typically 0.5-1% of loan amount, though many banks waive this during promotional periods

- Property Valuation: AED 2,500-3,500 for professional assessment

- Mortgage Registration Fee: 0.25% of loan amount plus AED 290 admin fee to Dubai Land Department

- Legal and Administrative Fees: AED 3,000-5,000 for documentation and processing

Example Break-Even Calculation: If refinancing costs total AED 18,000 and you save AED 1,500 monthly, your break-even point is 12 months. Any time you hold the property beyond that point represents pure savings. Most experts recommend refinancing only if you plan to retain the property for at least 2-3 years beyond the break-even point.

Top Banks for Mortgage Refinancing in Dubai 2025

Dubai’s competitive banking sector offers numerous refinancing options. These institutions currently lead the market with attractive rates and favorable terms:

First Abu Dhabi Bank (FAB)

Fixed Rates: Starting from 3.99% for 3-year terms

Benefits: Processing fee waivers for salary transfer customers, 180-day grace period before first installment, valuation fee waiver

Best For: High-value refinancing above AED 2 million

HSBC UAE

Variable Rates: 3-month EIBOR + competitive margin

Benefits: Strong expat support, flexible overpayment options (25% annually without penalty), established international presence

Best For: Expat professionals with international banking relationships

Emirates NBD

Fixed Rates: Competitive 3-5 year fixed terms from 3.85%

Benefits: Fast approval process, digital application platform, flexible loan amounts

Best For: UAE nationals and long-term residents seeking streamlined processing

Mashreq Bank

Hybrid Options: Fixed initial period transitioning to variable rates

Benefits: Customized refinancing packages, self-employed friendly, negotiable margins

Best For: Business owners and investors with complex income structures

When Does Refinancing Make Financial Sense?

Not every mortgage qualifies as a strong refinancing candidate. Industry experts recommend considering refinancing when these conditions align:

The 75 Basis Point Rule

Refinancing typically delivers meaningful benefits when the rate difference exceeds 0.75% (75 basis points). Below this threshold, costs often outweigh savings. However, this rule flexes based on loan size—larger mortgages justify refinancing at smaller rate differences.

- Property Retention Timeline: You plan to hold the property for at least 3+ years beyond break-even

- Market Timing: Current rates are significantly lower than when you secured your original mortgage

- Financial Stability: Your income and credit profile remain strong or have improved

- Property Value: Your property has maintained or increased value, ensuring favorable loan-to-value ratios

- Life Changes: You need to adjust payment terms due to career moves, family expansion, or retirement planning

The Refinancing Process: Step-by-Step Guide

Refinancing your Dubai mortgage follows a structured process typically completed within 4-6 weeks. Understanding each stage helps set realistic expectations:

Step 1: Financial Assessment (Week 1)

Calculate your current mortgage balance, review your credit score, and determine refinancing goals. Request a liability letter from your existing bank detailing outstanding balance and early settlement fees.

Step 2: Rate Shopping (Week 1-2)

Compare offers from minimum three banks. Consider total costs, not just headline rates. Negotiate processing fee waivers and request detailed quotes including all charges. Working with mortgage brokers like Red Horizon can streamline this comparison process.

Step 3: Application Submission (Week 2-3)

Submit required documents: Emirates ID, passport, salary certificates (last 6 months), bank statements (6 months), existing mortgage statements, property title deed, and any additional income proof. Most banks now accept digital submissions.

Step 4: Property Valuation (Week 3)

The new bank arranges professional property assessment. Valuers examine property condition, location, recent comparable sales, and market trends. Properties in premium areas like Creek Harbour typically receive strong valuations.

Step 5: Approval and Documentation (Week 4-5)

Upon approval, review loan offer carefully. Verify interest rate, fees, tenure, and all terms before signing. Coordinate settlement with your existing bank to close the original mortgage.

Step 6: DLD Registration (Week 5-6)

Register the new mortgage with Dubai Land Department. The new bank typically handles this process. Once completed, loan disbursement occurs, settling your original mortgage. Your new payment schedule begins based on agreed terms.

Frequently Asked Questions About Mortgage Refinancing

Can I refinance if I’m self-employed?

Yes. Self-employed individuals can refinance but require additional documentation including 2-3 years of audited accounts, trade licenses, and proof of business stability. Banks like Mashreq and RAK Bank offer self-employed friendly refinancing programs.

How does refinancing affect my credit score?

The application process involves a credit check that may temporarily impact your score. However, successfully refinancing and maintaining consistent payments improves your credit profile long-term. The positive effects typically outweigh any short-term inquiry impact.

Can expats refinance their mortgages in Dubai?

Absolutely. Expats with valid residence visas and stable employment can refinance. Requirements are similar to UAE nationals, though some banks may require slightly higher income thresholds or impose lower loan-to-value ratios.

Should I refinance with my existing bank or switch?

Always compare both options. Your existing bank may offer loyalty rates to retain you, potentially waiving some fees. However, competitive shopping often yields better terms. Many homeowners find switching banks produces superior savings despite the additional administrative work.

What happens to my original mortgage insurance?

Closing your original mortgage terminates that policy. You’ll need new property insurance and potentially life insurance for the refinanced loan. This presents an opportunity to review coverage and potentially secure better rates through improved health or property condition.

Can I refinance an investment property or only my primary residence?

Both primary residences and investment properties qualify for refinancing. Investment property refinancing may involve slightly different terms or rates, but the process remains similar. Many investors refinance to optimize their rental property portfolios across Dubai.

Expert Refinancing Guidance from Red Horizon Dubai

Navigating mortgage refinancing requires expert knowledge of Dubai’s banking landscape, current rate trends, and negotiation strategies. At Red Horizon Dubai, our experienced mortgage consultants have helped hundreds of homeowners save millions of dirhams through strategic refinancing.

We analyze your current mortgage, compare offers from multiple banks, calculate your true break-even point, and negotiate the best possible terms on your behalf. Our comprehensive service includes handling all documentation, coordinating with banks and DLD, and ensuring a smooth transition to your new mortgage.

Whether you own property in prime Dubai locations or are considering refinancing your investment portfolio, our team delivers personalized solutions that maximize your savings.

Making Your Refinancing Decision

Mortgage refinancing represents one of the most impactful financial decisions Dubai homeowners can make. With current rates at multi-year lows and banks competing aggressively for refinancing business, 2025 presents exceptional opportunities for strategic mortgage optimization.

The key to successful refinancing lies in thorough analysis—understanding your current mortgage terms, calculating precise break-even points, comparing comprehensive offers, and timing your refinancing to maximize savings. Don’t rely solely on headline rates; examine total costs, loan flexibility, and long-term implications for your financial goals.

For homeowners in Dubai’s thriving property market, refinancing isn’t just about reducing monthly payments. It’s about optimizing your entire financial position, whether that means accelerating equity buildup, accessing capital for additional investments, or simply ensuring you’re not overpaying for your home loan.

Start your refinancing journey today by requesting your liability letter, comparing current market rates, and consulting with mortgage experts who understand Dubai’s unique real estate and banking landscape. The savings you generate through strategic refinancing can fund your next investment, accelerate your financial independence, or simply provide the peace of mind that comes from knowing you’ve optimized one of your largest financial commitments.

Remember: Every month you delay refinancing is a month of potential savings lost. With rates at favorable levels and banks eager for your business, now is the ideal time to explore how mortgage refinancing can transform your financial future in Dubai.

Comments